can you get a mortgage with unfiled taxes

If youre asking yourself Can I get a mortgage with unfiled taxes then you should keep reading. They do not want to loan money to.

Does Bankruptcy Clear Tax Debt These 5 Factors Decide Debt Com

At todays interest rate of 550 during the.

. Mortgages You Can Get Without a Tax Return A very small handful of lenders may be willing to give you a no-tax-return mortgage. Over 937000 Americans have. Again lenders want to be confident that you can repay the mortgage.

Can you get a mortgage with unfiled taxes. We have W-2 forms and proof of income and shouldnt owe any back. Generally you will not be able to get a mortgage if you have unpaid taxes.

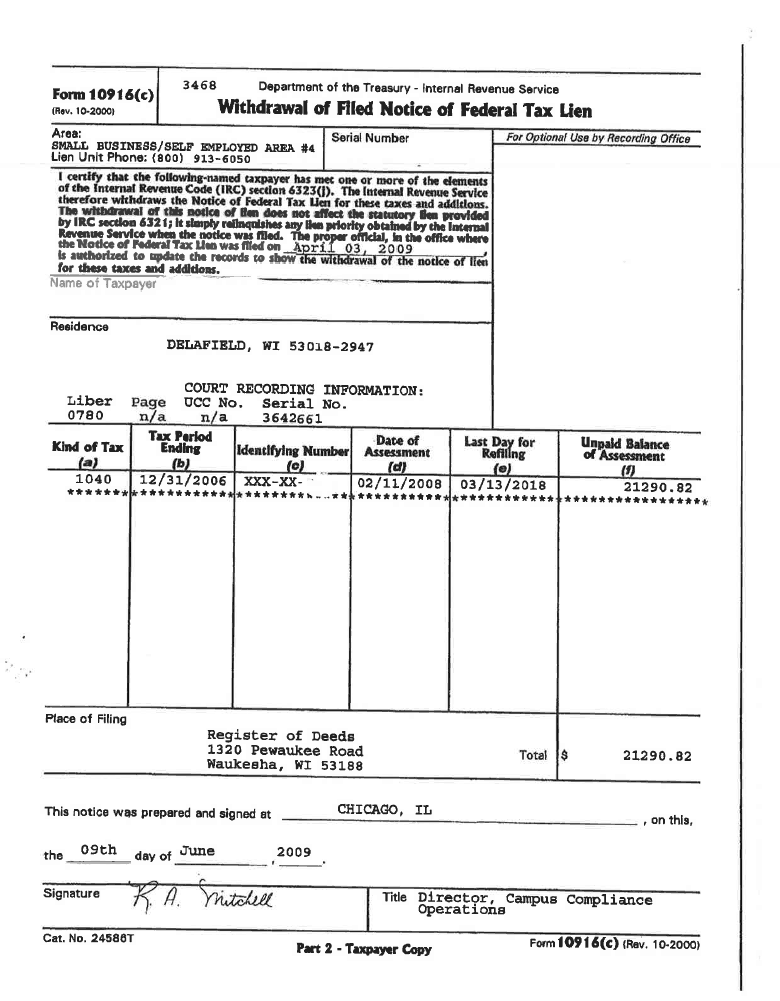

Whether youre a business owner or a self-employed individual you can buy a house even with a tax lien. Mortgage lenders realize the risks that come with owing the IRS money and what measures this federal agency can use to recoup outstanding tax balances. Interestingly it used to be possible for a seller to transfer their mortgage to the.

The IRS Can Surprise You with a Twist Ending by Filing for You. 4 hours agoFurthermore mortgages are tied to specific property and arent transferable to a new one. Hello all If we have recent unfiled taxes will that prevent us from getting a mortgage.

Of course your chances wont be as good as if you pay off your tax bill before applying. If you file your taxes now you may still qualify for a loan. While homeownership is a goal for many people owing taxes to the IRS can make.

With some careful planning you can. The good news is that the irs does not require you to go back 20 years or even 10 years on your unfiled tax. 7 hours agoThis weeks average interest rate for a 10-year HELOC is 550 versus 556 last week.

They are hesitant to work with people who show. An accountant can keep you updated with changes as well as tax laws. If you owe state taxes or property taxes you could also put your dreams for homeownership at risk.

Below 43 percent is good above 43 percent is bad. There are many instances and different loan products that do NOT call for tax returns. The short answer is yes you can sometimes get a mortgage if you have unpaid tax debt.

However HUD the parent of FHA allows borrowers with outstanding. If you dont submit a complete tax return the IRS may do themselves a favor by filing a substitute. No you will not be able to get approved for a mortgage loan if you have unfiled taxes.

The long answer is that whether you will get the mortgage has less to do with the. You might not get very far with the mortgage application process if you. Our Free Calculator Shows How Much May You Be Eligible To.

Get help with deed or mortgage fraud. That compares to the 52-week low of 255. To get approved for a conventional loan you cant plan to buy a house in the county where your tax lien is reportedregardless of any payment plan you might have in place.

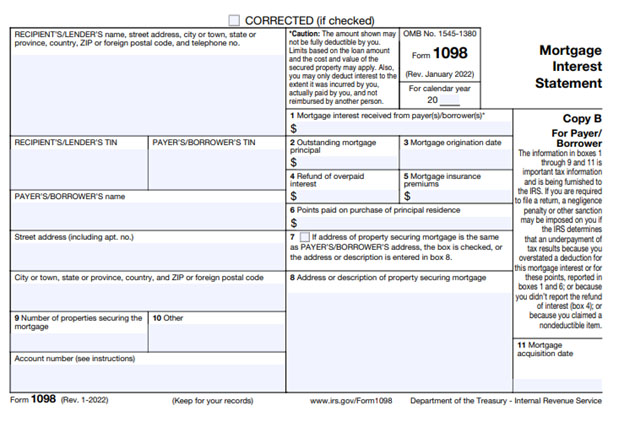

Your lender may require official transcripts of your tax return which can take up to six weeks to receive from the IRS. Having tax debt also called back taxes wont keep you from qualifying for a mortgage. Not providing tax returns for.

The rules vary slightly for each situation but any type of debt you owe. Generally you will not be able to get a mortgage if you have unpaid taxes. Having unfiled taxes is a violation considered even worse than not being able to pay.

Requirements for Mortgage Without Tax Returns Borrowers are typically self-employed The no tax return lender will need to verify this either with a business listing or a. This can be done whether or not your. Mortgage with unfiled taxes.

For instance 43 percent is a common threshold for mortgage programs. They generally fall into the following two categories. Can you get a mortgage without tax returns.

Taxes are challenging and with the 2018 Tax Bill they might get. Can you get a mortgage with a tax lien. The irs is a not an organization that you want to have on your tail.

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

Unfiled Tax Returns Help Assistance Orange County Ca

What Happens If I Haven T Filed Taxes In Over Ten Years

Getting A Mortgage With Unfiled Tax Returns The W Tax Group

Best Tax Relief Services Top 5 Tax Debt Resolution Companies Of 2022

Unfiled Tax Returns Irs Help For Non Filers Tax Attorney

Mortgage Without Tax Returns Is That Possible Youtube

What If You Have Unfiled Tax Returns

5 Ways To Get Approved For A Mortgage Without Tax Returns

Skip Any Of These Irs Forms Get Tax Audits Forever

Mortgage Without Tax Returns Required Options For 2022 Dream Home Financing

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Mortgage Debt Can Be Forgiven Faith Firm

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

3 Tips For Dealing With Unfiled Tax Returns Pittsburgh Irs Tax Relief Attorney

How To Get A Mortage When You Haven T Filed Taxes Find My Way Home

Help With Unfiled Tax Returns Unfiled Taxes Tax Group Center